We should put resources into a proper (trustless, serverless, maximum Uniswap-like UX) ETH < – > BTC decentralised exchange. It’s shameful that we still can not just move trustlessly between the two largest crypto ecosystems.” – Vitalik

Basics of Crosschain Swap :

It is a third-generation blockchain technology that allows two independent blockchains to interact and share resources. This improves interoperability between blockchains and allows them to develop different use cases for different industries.

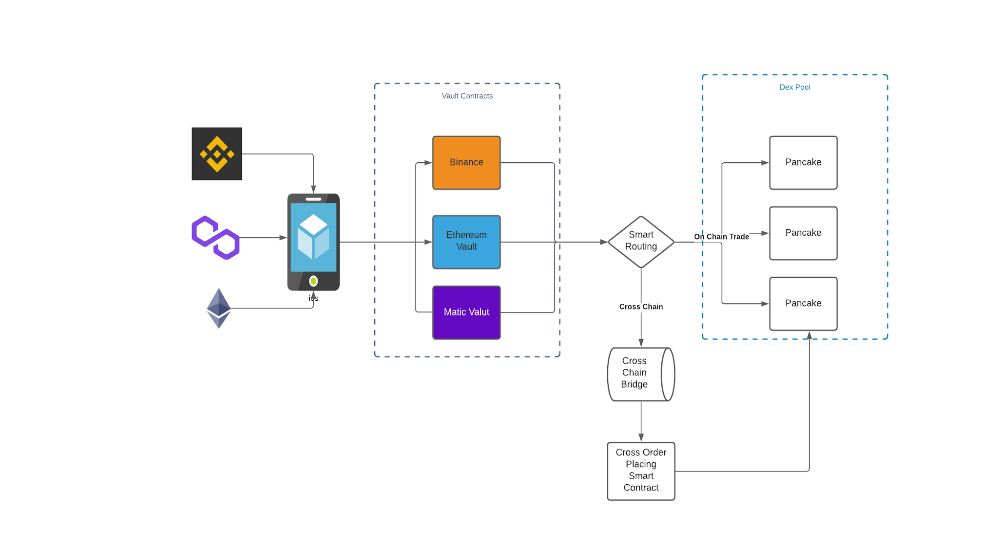

Develop multi-chain blockchain wallets for iOS and Android that can support Binance, Ethereum, and Polygon, with the ability to extend the wallet to other blockchains in the future. The wallet will have the ability to trade across all on-chain markets by placing an order.

Different ways of Developing Crosschain Swap and Bridge

Placement of orders

Users place the orders and deposits in a self-destructing smart contract called Smart Vault. The Smart Vault are the contracts that will hold the user coders and will be managed by the user for order placement and cancellation. Smart Vault will add liquidity to the market and limit swaps. They will also act as liquidity providers in executing the transactions.

Smart routing

Order routing will be done via IR contracts, which will be accompanied by the bots. The IR contracts will check the liquidity available in the other dexes and either forward the order to the efficient dex for order matching.

Crosschain Trading

If the user explicitly asks for cross-chain assets, they will place an order through Smart Vault by specifying a cross-chain. Our integrated IR routing checks liquidity across the chain and then executes the swap on the cross-chain. Right now, our focus is on the 0x protocol for cross-chain and we will continue to build it out for other chains as more layers are added.

Advantage of this approach.

- Cheaper execution of trades across multiple dexes.

- Cross-chain compatibility

- Multi-chain wallet with bridge capabilities.

- Faster settlement of funds.

- Lowest transaction fee.

The cross-chain bridge that ends all bridges – development of the crosschain swap protocol.

- Cross-chain bridges exist in the marketplace, but not without flaws – namely, fees, vulnerabilities, delays, exploits, and more. And while bridges exist as separate entities, no bridges have yet been integrated for true cross-chain trading. We can build true cross-chain and cross-exchange liquidity aggregation in market-wide interoperability.

- Users can trade popular ERC20 assets with the low fees and high speed of the Binance Smart Chain. Other chains can also be integrated to further reduce fees while increasing speed, asset availability and more.

- Fusion’s DCRM technology features an automated pricing and liquidity system. This protocol can enable swaps between different coins on any blockchain that uses ECDSA or EdDSA as its signature algorithm, including FSN, XRP, LTC, BTC, ETH, USDT, etc. And the wallets support Ledger and Metamask wallets.

- Programmed pricing and liquidity. This means that liquidity providers will be able to add and withdraw liquidity from the swap pair. The programmed pricing system is entirely based on the liquidity provided.

- Cross-chain swaps. Users will be able to swap one coin for another instantly.

- Decentralized cross-chain bridge.

Explanation of Fusion’s DCRM technology

DCRM stands for Decentralized Control Rights Management. It is a truly interoperable solution that is more powerful than atomic swaps and presumably more secure than shared storage methods.

It offers distributed key generation, which means that the private keys that control assets are never exposed – from generation to actual storage. This is a significant advance in security, and it is stronger than other secret sharing systems. At the same time, it provides distributed transaction signing. This means that transactions can be executed with the consent of nodes and tailored to a set of required minimum signatures. The inherent qualities of the technology make it suitable and preferred for a number of different applications, which include the following.

Cross-chain and cross-system

Taking advantage of decentralized custody models that hold and transfer assets on behalf of actual users across different chains provides opportunities that greatly extend the functionality of different systems.

Liquidity of hot wallets and security of cold wallets.

The distributed key management system mentioned above can be deployed as a non-custodial solution for various DeFi use cases or as a hot wallet solution for centralized enterprises such as exchanges, wallet providers or custodians.

These solutions can be extended with key recovery and compliance checks – compelling features of DCRM.

The problems that Brugu can solve

Other bridges such as Multichain (Anyswap), Optimism, and Polygon rely on layers of validators and are therefore vulnerable to exploits (as we see monthly). This reliance on validators means that the bridges are not truly decentralized or secure.

Optimism relies on a single sequencer through the Optimism team and validators, with the risk of incorrect transactions and subsequent loss of deposits and penalties. Polygon’s security is provided by PoS validators and is therefore vulnerable to vulnerabilities.

Multichain (Anyswap), on the other hand, relies on 33 nodes to validate, sign, and disseminate cross-chain transactions.

Brugu can strategically drive some solutions such as Non-custodial+MPC, Native Swap, and the development of multichain routers. The multichain router allows users to switch between two chains at will, reducing fees and making it easier to switch between chains.

The Solution that Brugu Can offer:

Trading on DeFi protocols can be a cumbersome experience – whether you are an experienced trader or a first-time user. With a variety of platforms accessible to traders, from CEXs and DEXs to individual DeFi projects, there is a need for a platform to facilitate trading without compromising on security and offers everything a trader needs for a smooth trading experience, users should able to tap into the deepest liquidity in the market at the best prices with minimal slippage. Brugu Innovative strategies can raise the bar to set a new standard for security in crypto trading.

Defi Staking Platform

DeFi Staking platforms allow users to profit from their funds by locking a certain portion of the platform’s own token. In addition, Defi Staking allows you to become a validator in any POS (Proof-of-Stake) blockchain platform.

With the cross-chain DeFi Staking platform development by us in control, staking can be done for various unique blockchain ecosystems. Users can become validators for different blockchains and use their funds to increase profits.

Final view

Through an intricate back-end integration process, the Brugu team constantly works towards growing the platform and bringing additional value to users. The Ecosystem can be easily scaled to new blockchains and exchanges, tapping into new resources and expanding its current pool of assets. Complementary value proposals allow for exponential and scalable growth of the ecosystem, the greater the value offering of aggregating platforms.

However, as technology continues to advance and the demand for decentralized finance increases, technologies such as cross-chain are becoming increasingly important. As a result, it is being added to the existing Defi and crypto ecosystem to make the entire infrastructure more robust.

Speak to expert

Speak to expert

Be First to Comment